Understanding ESG, part 2

Catherine Tansey – Feb 28th, 2024

In part 1 of our series, we looked at the history of ESG and briefly touched on HR’s role in it. In this second post we’ll examine the current workplace implications of ESG and discuss how it shows up in practice for HR professionals.

For years ESG has been the domain of a board committee or two, or else some far off corporate nice-to-have. But today, ESG’s weighty talent implications have pushed it directly into HR’s sphere.

This is not without complications.

Like DEI, ESG has in recent years become a flashpoint in the culture wars. Propelled in no small part by Elon Musk, the backlash against ESG has turned it from a well-intentioned investment philosophy into corporate America’s latest “dirty word.” Some businesses have responded by rebranding their ESG efforts. What was once ESG may now be known in some places as “Responsible Business.”

No matter what you call it, it’s clear that ESG will remain at the forefront of business decisions for years to come, as issues like climate change and social and economic justice promise to transform how businesses operate and what employees expect from employers.

Navigating these choppy waters is important, difficult work. In this article, we’ll explore what it all means for HR & DEI teams today.

ESG as a talent imperative

As ESG continues to matter more to more stakeholders, it’s up to HR to develop programs, drive strategy, and manage the requisite reporting to support ESG initiatives.

Employees in particular are paying close attention to ESG, as values alignment has become a sort of career north star for many today, especially Millennials and GenZ.

Professional services consulting firm Marshal McLennan found that the most attractive employers to Millennials and GenZ workers have 25% higher ESG scores than the global average. Poised to inherit the worsening effects of climate change, younger generations are more concerned with social and environmental responsibility than previous generations, and they’re evaluating potential employers for verifiable ESG commitments.

While younger generations tend to be the most vocal, they’re not the only ones who recognize ESG’s value.

The most attractive employers to Millennial and GenZ workers have 25% higher ESG scores than the global average.

A 2021 Deloitte x Forbes Insights survey of 350 senior leaders found that “38% indicated that embracing strong ESG values enhanced their ability to attract and retain talent.” Even better? Once employees are in the door, a good track record on ESG is linked to more content employees. Marshal Mclennan found that the employers considered top-employers by way of employee satisfaction have 14% higher ESG scores than the global average. As HR teams look to remain competitive as employers, ESG is an imperative.

Alongside the call for ESG from a talent lens, regulatory forces have also begun to demand more corporate ESG accountability. In just the past few years, we’ve seen pay transparency laws crop up across states and local jurisdictions, new mandates for cybersecurity risk, disclosures, soon-to-come requirements for human rights reporting on supply chains, updates from the FTC on “green guides,” and signals from the SEC that widespread DEI reporting requirements for publicly traded companies is on the near-horizon

Where HR teams can drive ESG impact

We’ve talked about the history, theory, and talent implications of ESG, but what does it look like from a day-to-day perspective for HR teams?

In practice, ESG comes down to two basic areas of responsibility for HR teams: 1) strategy and 2) reporting.

Strategy

These are the steps businesses take to work toward and align with their ESG goals. Broadly speaking, the ESG programs that HR touches today are centered more in social and governance aspects than environmental.

Much of “social”—the “S” in ESG—is HR’s domain. They manage people programs across the employee lifecycle, beginning with the candidate experience across onboarding, through training and development, and eventually to exit interviews and separation.

When it comes to governance, HR programs support elements like demographic makeup of the board, whistleblowing policies, and demographic makeup of the board.

Reporting, communication, and compliance

Reporting is a vital component of ESG work. It is how businesses communicate to stakeholders — employees, investors, and regulators — how they’re progressing on their commitments.

“The metrics and reporting component of ESG is essential,” says Jason Gong, DEI Lead at Dandi. Without accurate, intersectional data to demonstrate position and progress, companies can face non-compliance fees, risk losing funding, or fail to attract talent.

Reporting can take a number of different forms, each important. It can be internal, regulatory, or external, like impact reports.

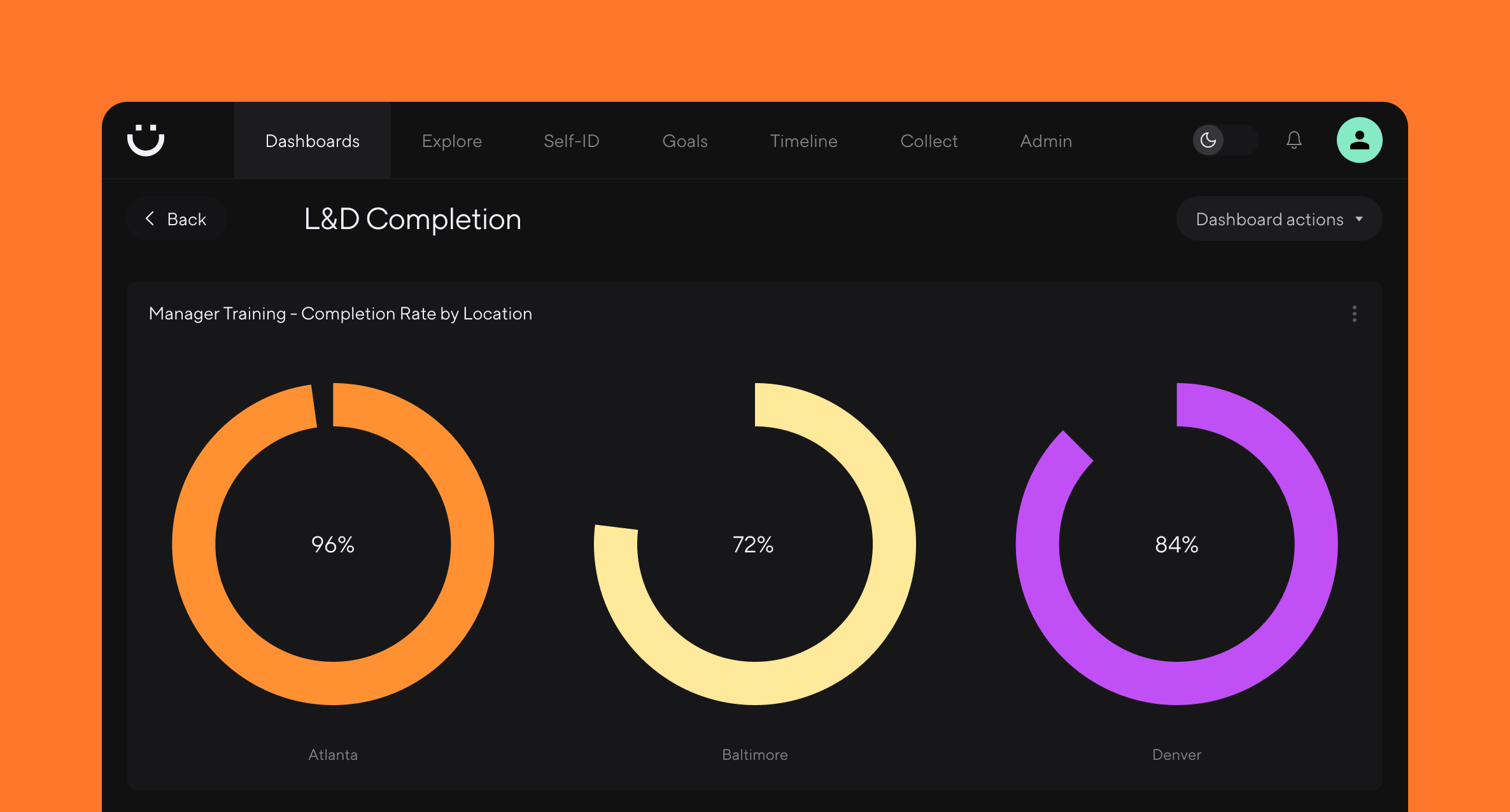

Internal: HR must report on the progress of its ESG programming to internal stakeholders to establish accountability, manage risk, and bolster stakeholder trust. When it comes to ESG, HR may be reporting internally on DEI, compensation, employee engagement, attrition and retention, community impact, learning penetration, and more.

Regulatory: HR is facing an increasingly expansive regulatory environment when it comes to ESG and needs the ability to report on a broad range of subjects to various governing bodies. These may include pay audits, board diversity, workforce data protection standards, human rights standards along the supply change, or even whistleblower programs.

External: Impact reports are (most-often) public documents that share metrics, goals, successes, and hurdles of a company’s ESG journey for a given period of time. Creating an impact report is no low lift — HR will need to collate data from self-ID campaigns, engagement surveys, employee feedback, and a host of HRIS data — but they can have outsized impact for a company that’s serious about ESG. As a way to communicate a verifiable ESG commitment to various stakeholders, like employees, lenders, investors, customers, and prospective employees, impact reports provide accountability and progress tracking and can reinforce your employer brand.

Understanding where DEI and ESG do–and don’t–overlap

While DEI technically and theoretically slots under the ‘S’ of ESG, or could, most companies see these as separate. “The knowledge, skill, and empathy required to run a DEI program is distinct from what’s needed to oversee ESG,” Jason says.

However, as the landscape of ESG continues to shift, we’re likely to see more association between DEI and ESG at organizations. Recent ESG rulings/regulations related to DEI may serve to accelerate this, like NASDAQ’s requirements for companies listed on the exchange to disclose diversity demographics, or the SEC’s recently published Diversity, Equity, Inclusion, and Accessibility Strategic Plan, which, in part underscores the SEC's commitment to leveraging its regulatory influence to promote DEI across the broader financial landscape.

The more that compliance requirements overlap into DEI, the more likely it is we’ll see ESG and come closer together from an org chart perspective.

New data out from management consulting firm Kearny suggests regulation could support DEI in a much-needed way. In their recent report Kearny Index of Social Performance, which surveyed 602 companies, the firm found that 27% of companies reported not having any DEI strategy in place, and 20% relying on ad hoc DEI strategies.

The more that compliance requirements overlap into DEI, the more likely it is we’ll see ESG and come closer together from an org chart perspective. But while DEI may fit neatly under the social agenda in theory, a meaningful DEI-specific budget and headcount are required to move the needle on DEI strategy.

Reporting drives ESG success

Once the purview of board committees or more recently Chief Sustainability Officers, ESG and HR now intersect with increasing frequency. As HR takes on the shifting regulatory requirements for ESG compliance, HR teams need powerful reporting and data visualization tools to keep.

More from the blog

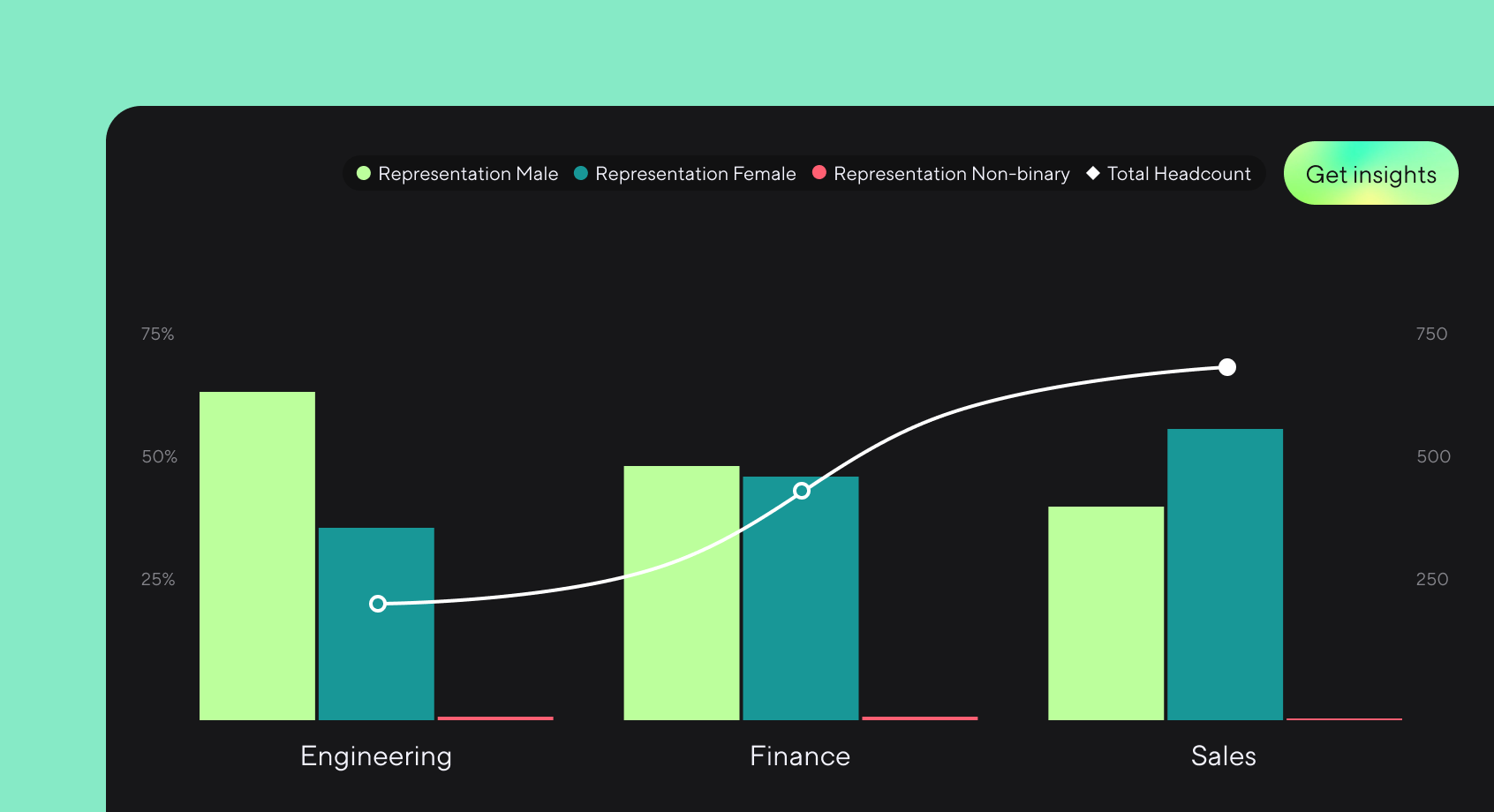

Announcing more powerful Dandi data visualizations

Team Dandi - Oct 23rd, 2024

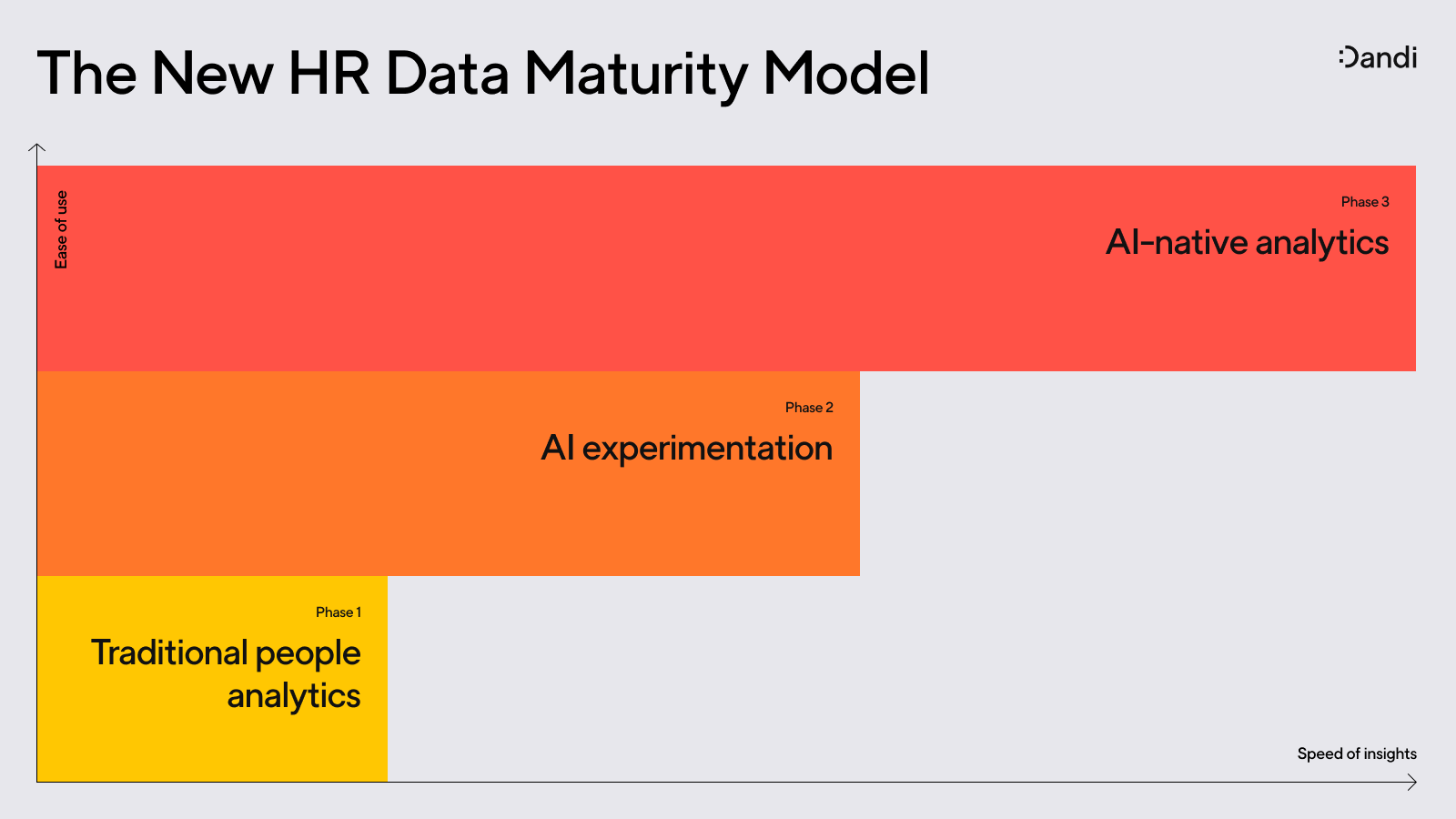

The New Maturity Model for HR Data

Catherine Tansey - Sep 5th, 2024

Buyer’s Guide: AI for HR Data

Catherine Tansey - Jul 24th, 2024

Powerful people insights, 3X faster

Team Dandi - Jun 18th, 2024

Dandi Insights: In-Person vs. Remote

Catherine Tansey - Jun 10th, 2024

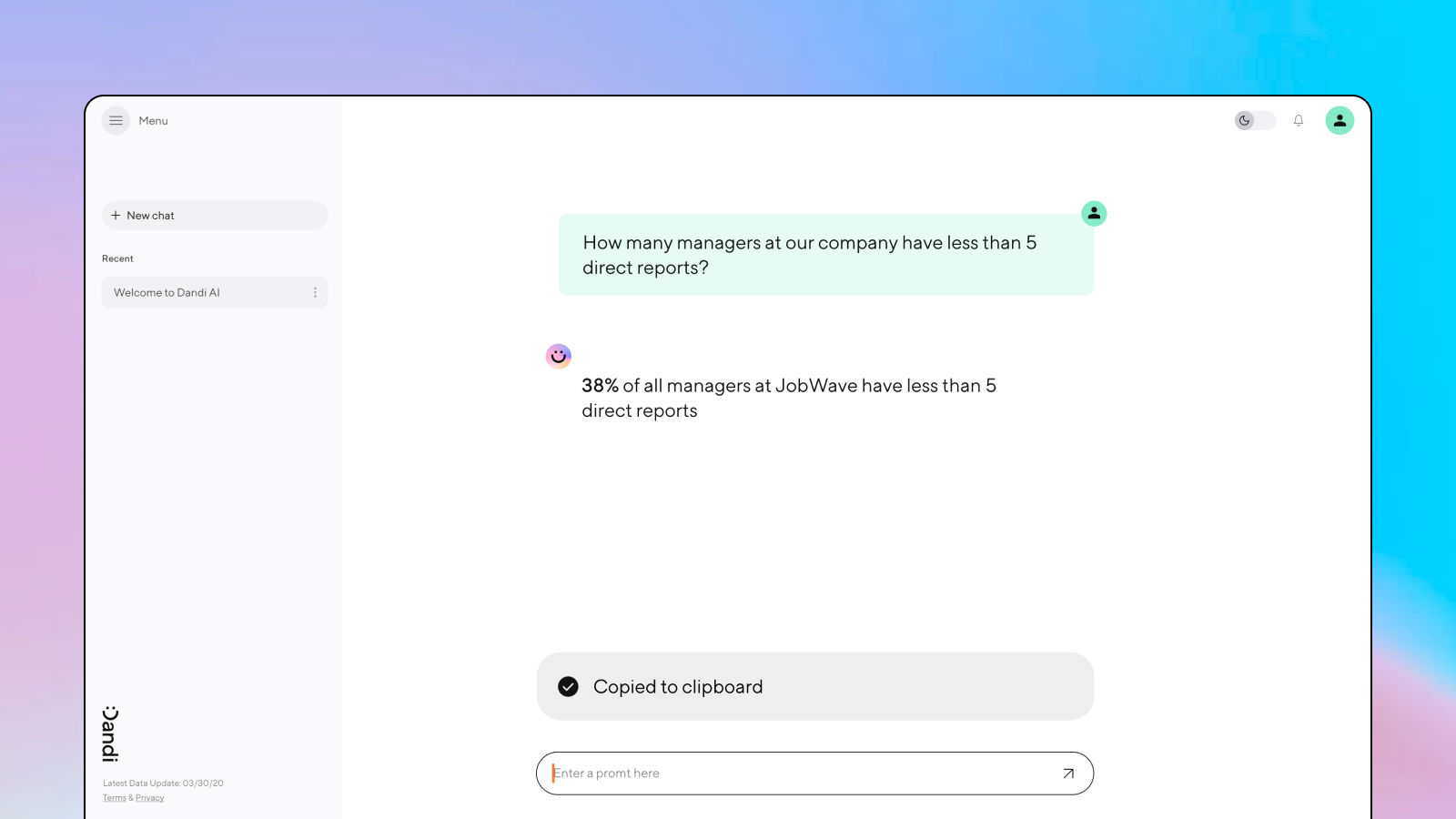

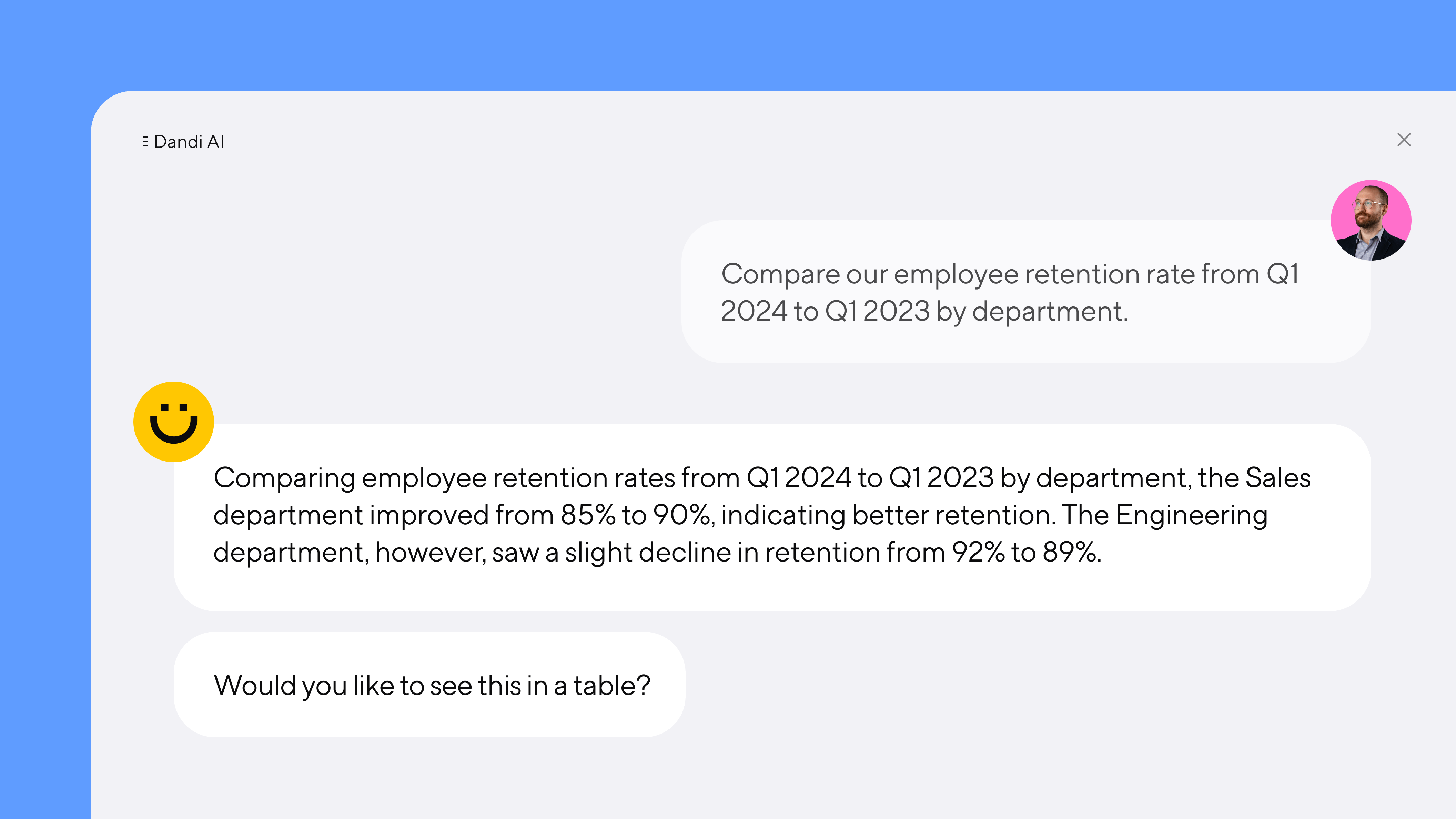

Introducing Dandi AI for HR Data

Team Dandi - May 22nd, 2024

5 essential talent and development dashboards

Catherine Tansey - May 1st, 2024

The people data compliance checklist

Catherine Tansey - Apr 17th, 2024

5 essential EX dashboards

Catherine Tansey - Apr 10th, 2024

Proven strategies for boosting engagement in self-ID campaigns

Catherine Tansey - Mar 27th, 2024