Understanding ESG, part 1

Catherine Tansey – Jan 9th, 2024

ESG is many things. A roving set of frameworks. A flashpoint in the culture wars. And an increasingly important topic for all manner of stakeholders, especially talent. In the first installment of a two-part series, we look at the history of ESG and its implications for HR & DEI teams today.

The last few years have seen a whirlwind of social, environmental, and geopolitical upheaval. In turn, people have become increasingly conscious—conscious of their consumption habits, conscious of their sustainability impact, and conscious of who they’re working for. Stakeholders, be they investors, lenders, customers, or employees, care more about good corporate stewardship than ever before.

ESG has emerged as a way for companies to concretely and visibly commit to the issues that resonate with people, offering organizations and individuals a framework to assess how closely a company’s values align with their own.

Yet, ESG is not without its challenges or critics. As more ESG and ESG-related regulations trickle out, we’ve also seen a wave of legal challenges from special interest groups.

While some are bringing ESG to court, job seekers and employees are prioritizing ESG as they evaluate prospective and current employers. This tension between regulation, pushback, and talent’s demand for it sets the stage for understanding ESG today.

What, exactly, is ESG?

ESG—which refers to a business's environmental, social, and governance practices—has come a long way. Originally, it referred to a financial strategy wherein investors prioritized long-term impact by addressing issues like climate change or systemic inequality. But today, ESG is more commonly used as an umbrella term for evaluating corporate ethics and sustainability.

- Environmental: Speaks to the company’s environmental and sustainability impact

- Social: Involves the company’s relationship with employees, vendors, customers, and community

- Governance: Relates to the structure and practices governing a company, and includes the demographic makeup of the board, shareholder’s rights, ethical business practices, etc.

Today, ESG is more commonly used as an umbrella term for evaluating corporate ethics and sustainability.

We often talk about ESG with respect to ESG regulations, or government standards for ESG-related metrics and reporting. These regulations are meant to incentivize companies to embrace more sustainable practices, enhancing transparency and corporate accountability while preventing deceptive practices. They also intend to provide investors more transparency about the strategic and operational preparedness of a company.

A brief history of ESG

While the term was only coined within the last two decades, the philosophy behind ESG has deep historical roots. From the Methodists who avoided investing in any ‘sinful trade’ to the Quakers who opposed the trade of enslaved people, an insistence on ethical business behavior is not new. It was the activism of the late 20th century that laid the foundation for ESG’s rise to prominence today.

In 1971, Luther Tyson and Jack Corbett, two United Methodist ministers opposed to the Vietnam War, created what’s today considered the first socially responsible mutual fund. Insistent that their church’s assets weren’t invested in companies contributing to the war, the duo founded Pax World, which later became Impax Asset Management.

Opposition to injustice continued to advance the nascent agenda of ESG, from the development of the Sullivan Principles, which encouraged ethical corporate behavior as a means of applying economic pressure to apartheid-South Africa, to the creation of the Global Reporting Initiative after the disastrous Exxon Valdez oil spill in Alaska.

While the term was only coined within the last two decades, the philosophy behind ESG has deep historical roots.

In 2004, under the leadership of Secretary General Kofi Annan, the UN officially coined the term “ESG” when they published their landmark Who Cares Wins report. The report shared recommendations on how to incorporate ESG considerations into financial analysis and asset management, which laid the groundwork for ESG as a financial strategy.

Money has always been political, so perhaps it’s no surprise that ESG has faced plenty of political infighting in recent years. Today ESG is a hot-button issue, with some decrying it as “woke capitalism” run amok.

In 2023 alone, more than a third of states have seen legal challenges against ESG regulations. Yet, as the Harvard Law School Forum on Corporate Governance points out, “while the flurry of recent anti-ESG legislative activity has attracted attention, it is important to view it within the context of broader recent federal activity in related areas,” like the passage of the Inflation Reduction Act, which funnels enormous sums into ESG-related investments.

But while there’s little agreement across the aisle on ESG, there is among younger generations. Whatever hurdles ESG may face in the coming years, we discuss further in part 2 of this series how GenZ is poised to ensure ESG continues on an upward trend.

HR’s role in ESG

ESG is at an inflection point where the scope of what constitutes ESG is expanding, while the number of companies reporting on it grows, too. Deloitte found that the number of companies not disclosing information about their overall ESG board governance plummeted from 28% to 3% between 2020 and 2022.

Alongside ESG’s rise in prominence come its implications for HR. Whether driven by regulations or guidance from state governments, industry regulators, or global initiatives, HR is now, or will soon be, tasked with reporting across a diverse range of ESG and ESG-adjacent metrics.

Consider just a handful of the of the ESG or ESG-adjacent changes we saw in 2023:

-

The European Commission's Corporate Sustainability Due Diligence Directive (CSDDD), which requires human rights and environmental data from large companies with any meaningful presence in the European market, is in negotiation and expected to take effect sometime before 2026.

-

On September 17, 2023, the state of NY’s pay transparency law went into effect

-

Via two objectives in its Diversity, Equity, Inclusion, and Accessibility Strategic Plan, the SEC signaled that it intends to use its regulatory power to mandate DEI reporting for all publically traded companies

-

California’s Senate Bill 54 was passed into law, requiring all venture capital firms to disclose DEI data on their portfolio companies

The number of companies not disclosing information about their overall ESG board governance plummeted from 28% to 3% between 2020 and 2022.

Alongside reporting, HR is also charged with developing the talent programs and strategies needed to support current and future ESG requirements. For example, as climate change worsens and environmental regulations increase, companies will face new talent demands. It’ll be up to HR to create talent pipelines and pools that deliver candidates with these new skills and expertise.

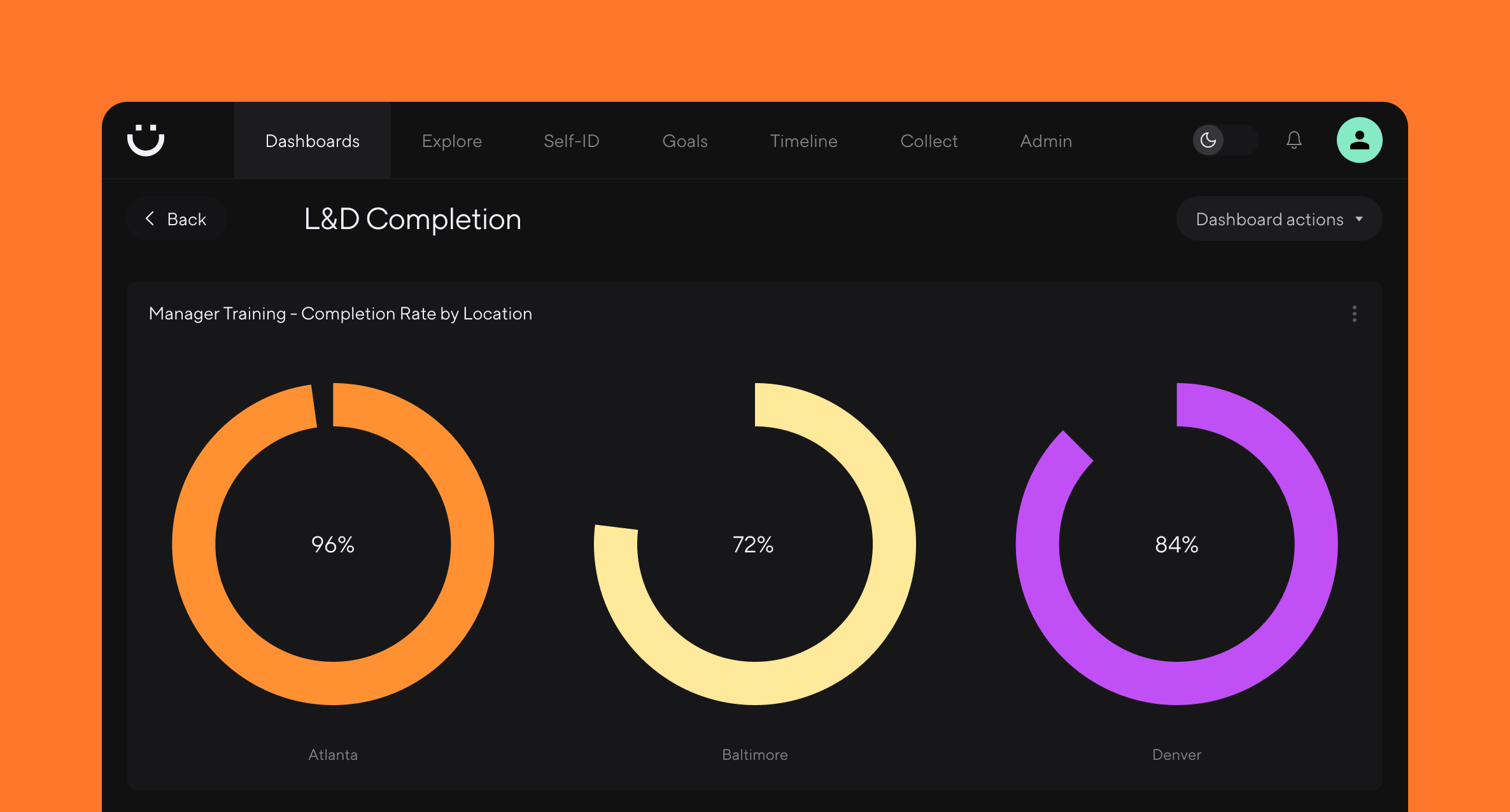

At the core of HR’s role in ESG is data. HR teams need streamlined ways to collect data, run reports, and collate metrics to form a cohesive narrative. Without data and reporting, the company has no meaningful way to communicate how they're progressing with ESG. This can put funding at risk, result in non-compliance penalties, and keep you from resonating with high-performing talent.

Long-term ESG success

Today, ESG is more of a roving set of frameworks than a single source of truth. HR must stay up-to-date with the evolving landscape to ensure compliance but also to keep the company prepared for future organizational demands. Moving forward, it’s clear that people teams need the right tools and tech to both meet regulatory needs, but also to support the programs and strategies being reported on.

Be sure to stay tuned for our next installment, when we look at ESG’s impact in the modern workplace.

Want to learn more about communicating your ESG impact? Download our 8-step guide to annual impact reports.

More from the blog

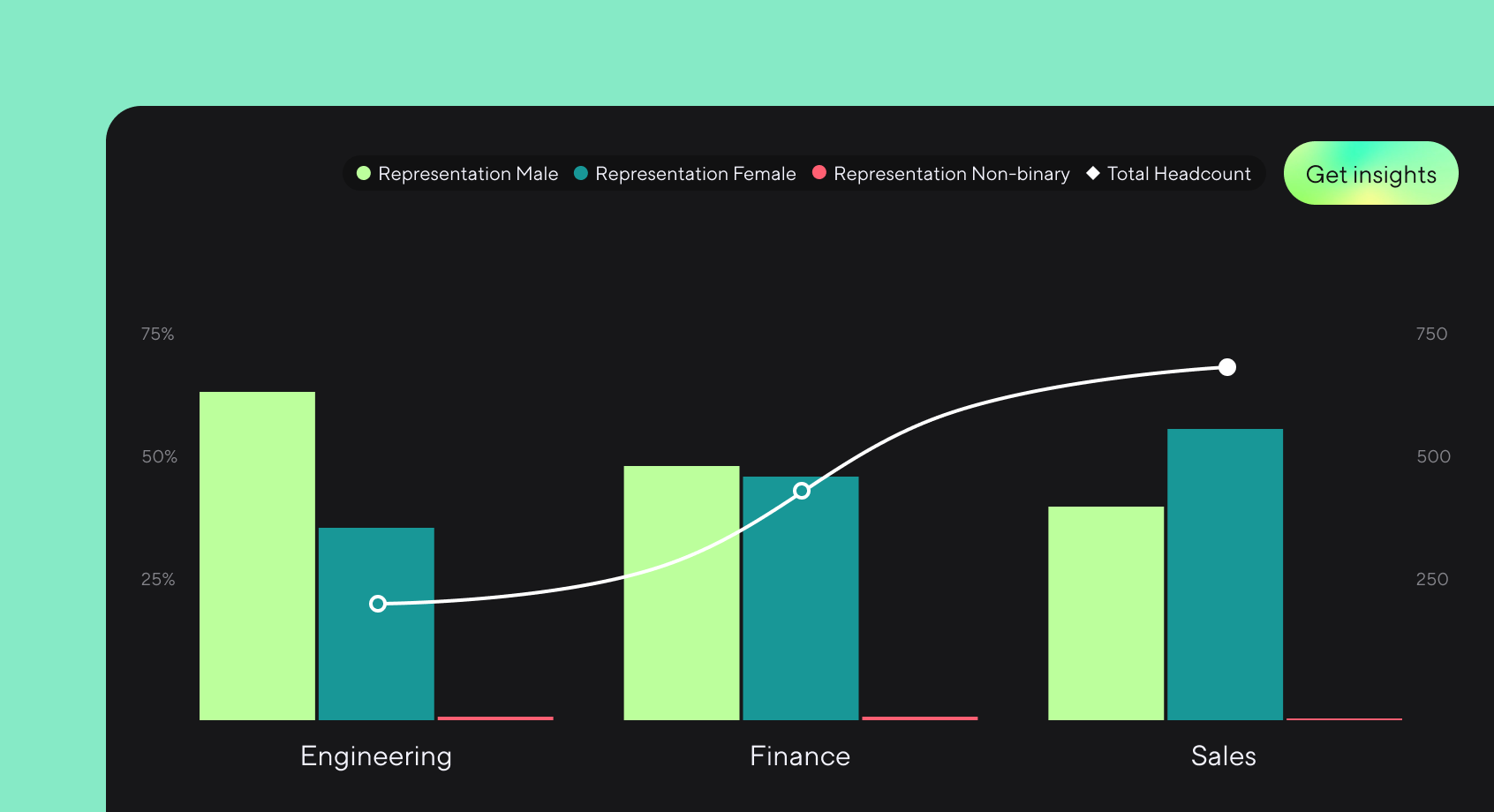

Announcing more powerful Dandi data visualizations

Team Dandi - Oct 23rd, 2024

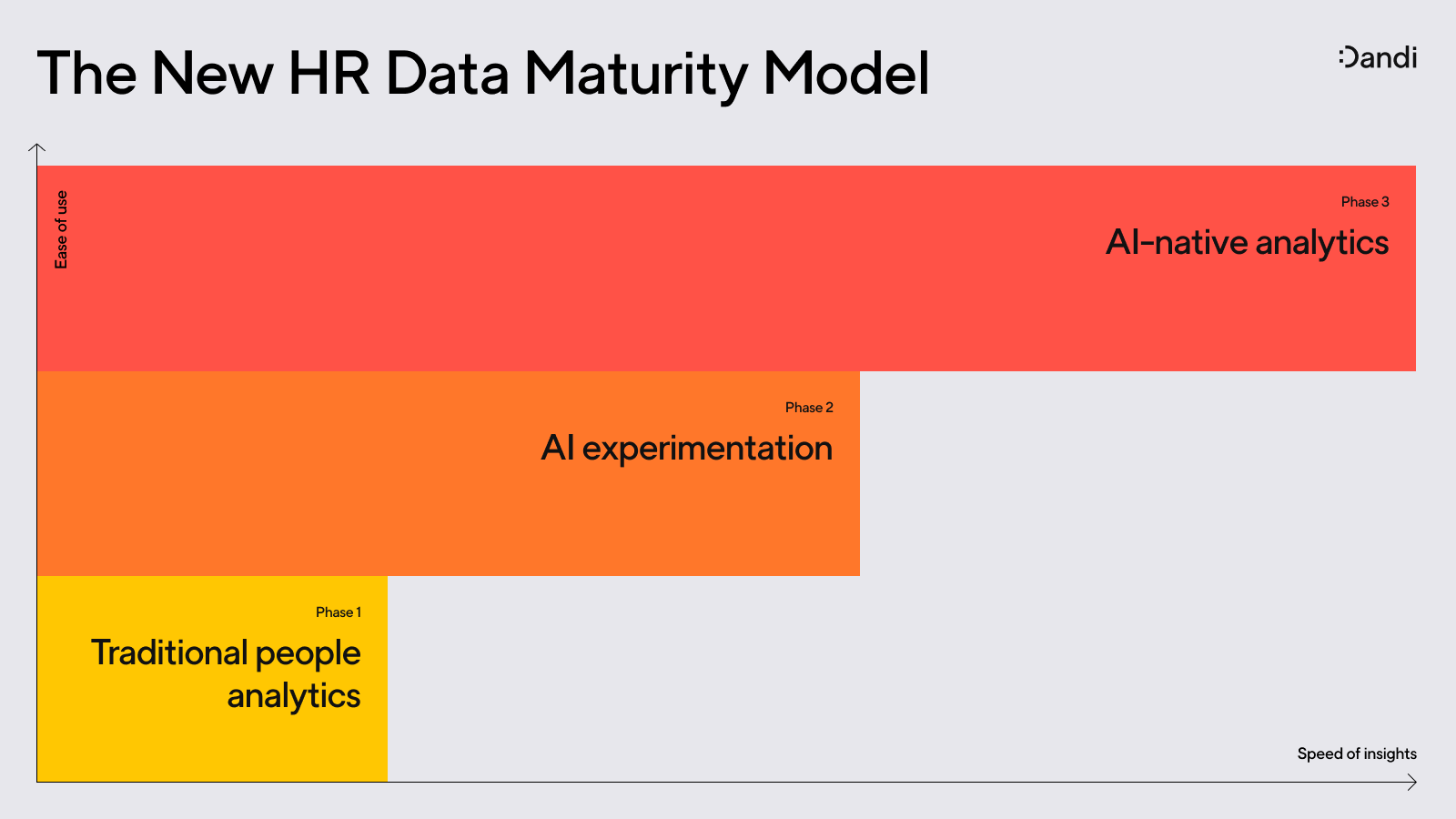

The New Maturity Model for HR Data

Catherine Tansey - Sep 5th, 2024

Buyer’s Guide: AI for HR Data

Catherine Tansey - Jul 24th, 2024

Powerful people insights, 3X faster

Team Dandi - Jun 18th, 2024

Dandi Insights: In-Person vs. Remote

Catherine Tansey - Jun 10th, 2024

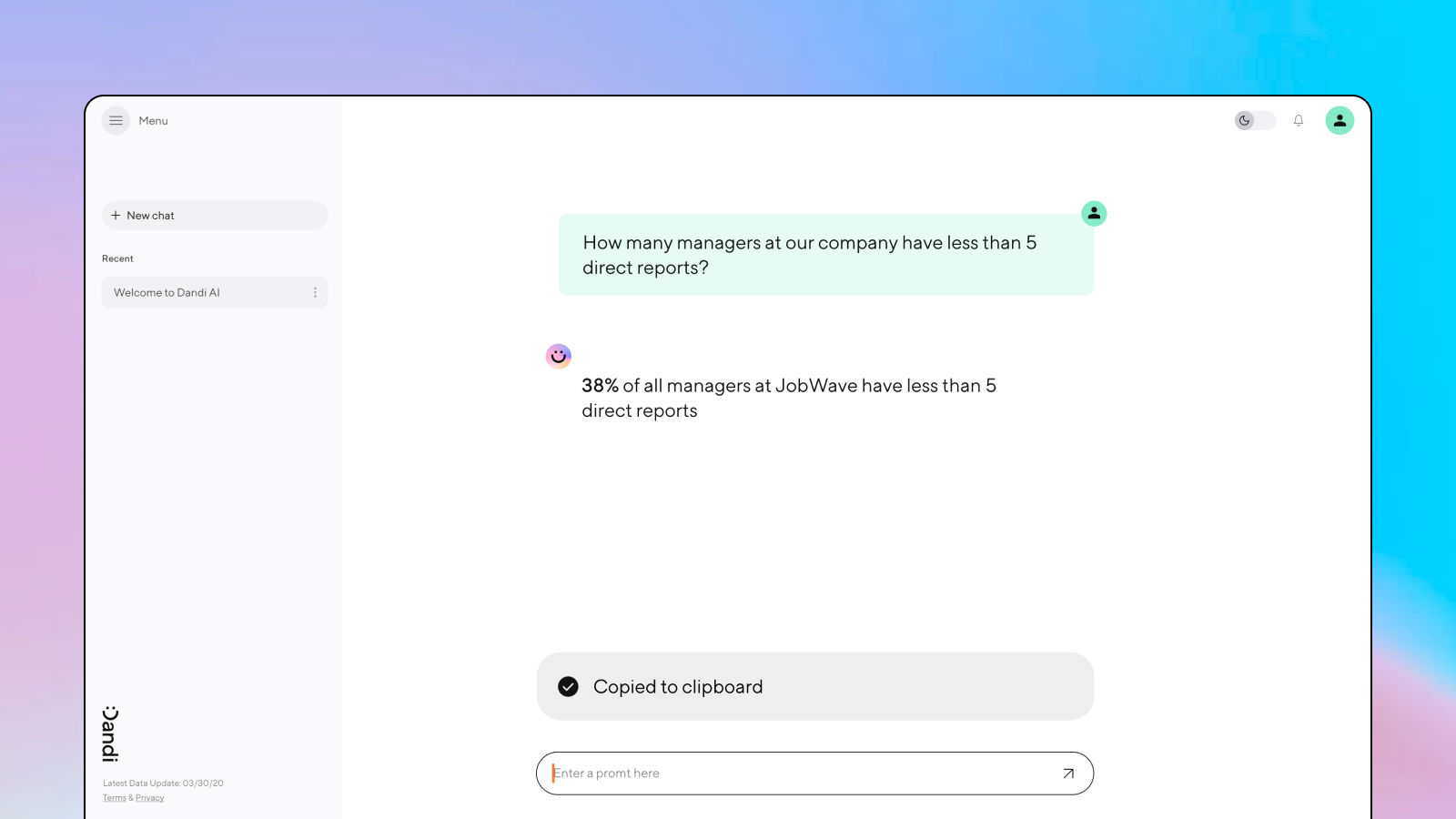

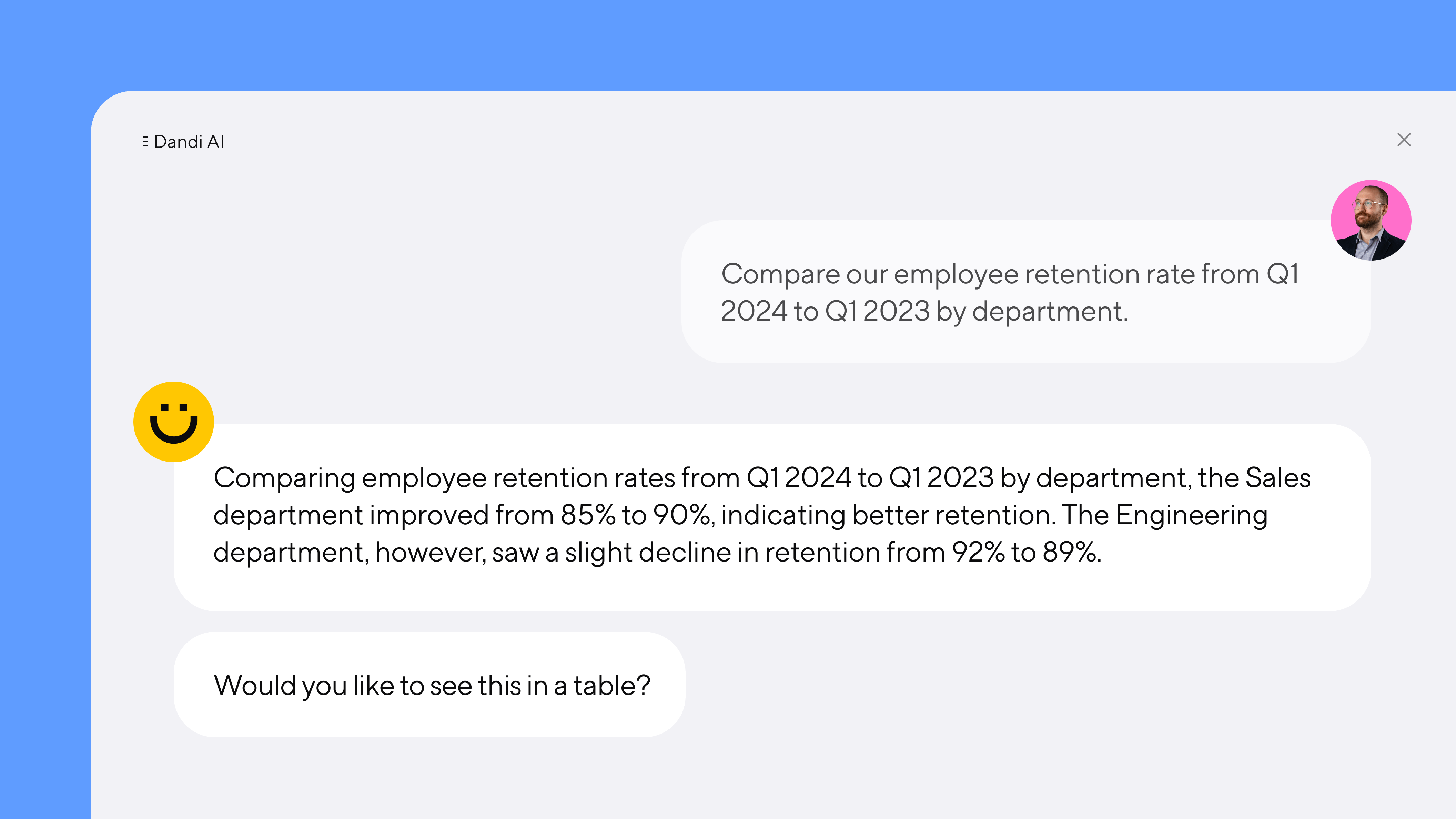

Introducing Dandi AI for HR Data

Team Dandi - May 22nd, 2024

5 essential talent and development dashboards

Catherine Tansey - May 1st, 2024

The people data compliance checklist

Catherine Tansey - Apr 17th, 2024

5 essential EX dashboards

Catherine Tansey - Apr 10th, 2024

Proven strategies for boosting engagement in self-ID campaigns

Catherine Tansey - Mar 27th, 2024